AEM Ever Tech

This is a chart request from my little ninja.

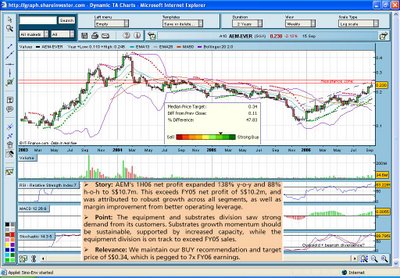

Fundamentally - AEM reported a good set of 1H 06 results and seemed to be the main beneficiary of an upswing in the semiconductor cycle! DBS gives it a 12 month target of 34 cents.

Based on 06F EPS of 4.9 Singapore cents, at 23 cents, it is last trading at a prospective PE of 4.7x (really cheap!) It's also trading below its projected 06 Dec book value of 24.7 cents! Assuming the Semiconductor upswing remains intact, this stock is really "value" for money.

Technically - AEM chart is on a nice uptrend but is entering its short term resistance zone around the 24-25 cents area. In order to see a better technical picture, i zoomed out to the weekly chart. Weekly chart pattern showed a 'shooting star' candle last week with overbought RSI and Stochastic. This may present a short term (1-3 weeks) correction down to the 21-22 cents support which in my opinion presents another opportunity to buy. The uptrend is likely to resume once the short term correction is over. If it breaks the 25 cents resistance, it should head towards the 30 cents mark.

0 Comments:

Post a Comment

<< Home