Friday, February 15, 2013

Wednesday, May 30, 2007

Never catch a falling gem?

Tuesday, February 06, 2007

My thoughts on Ninja Trading School

The most humbling experience in setting up this school is knowing that there are many traders who are better than me and yet as humble as ever to actually enrol in my school. hahaha. I dont think i can even trade as well as some of them. There are many hidden dragons among us and I am sure they will continue to do well in their trading. It is their willingness to share what they know that makes them outstanding little ninjas. Without their participation, my "classroom" would have beeen very boring and quiet. Thanks to all little ninjas who actively participate in classroom activities even when yours truly has been caught up in meeting, work and overseas travel.

The most pleasure i derive is to have a group of trading kakis who faithfully appear at 845 am and then disappear at 515pm each day at the trading room. We have indeed mastered the act of appearing and disappearing. Not to mention acquring the skills to watch over our shoulders in case our bosses caught us trading the market. Thanks for all the companion. We were all at a loss when we lost our internet connection due to a small earthquake in Taiwan.

For all the little ninjas who went through this journey with me, thanks for your patience and understanding. I had a great time enjoying your friendship. I hope to continue sharing my trading journey with you. May we continue to enjoy a trusting and fulfilling journey together as each of us seek to find our own personal trading style.

Monday, February 05, 2007

China Milk

Monday, December 04, 2006

OCBC Investment Roadmap 2007

I attended the OCBC Investment Roadmap 2007 on Saturday Dec 2, where Daryl Guppy was invited as a guest speaker. To be honest with you, I bought his book "Market Trading Tactics" sometime back and I was never impressed with that book. This perception was somehow 'reinforced' today as I walked away learning nothing new except for a slightly better understanding of how Guppy Multiple Moving Average indicator works. He could be a really good trader but somehow I wasn't able to tap into his 'knowledge'.

Anyway, the session on Winners for 2007 by Carmen Lee, the Head of OCBC Investment Research was more interesting. This is the session where she gazes into the crystal book and stick out her neck with 2007 predictions.

Her key message were:

- Mid tier property market will catch up in 2007

- Electronics may become a 'laggard' play as this is one sector that has lagged the entire market in 2006

Her winners for 2007 will come from the following areas:

- Corporate Earnings visibility where earnings for 2007-2008 are clear, such as those in the oil-linked companies (Sembcorp Marine and Kep Corp) with strong order books.

- M&A. Singapore has been relatively quiet on this M&A front where even Malaysia is even more active. The M&A scene will likely heat up here.

- Undervalued stocks with low price, high yield may find favour in 2007 but investors need a lot of patience and holding power

- China Consumer play will still be in vogue

- SC shares - Spore listed, non-PRC owner but with PRC exposure such as Raffles Education, HTL, Pacific Andes and Man Wah etc may find favour.

Her 2007 theme is to buy value stocks and her stock picks for 2007 are as follows:

- Ezra

- Sembcorp Marine

- Genting (hot favourite for Sentosa IR)

- Pine Agritech

- ST Engineering

- Singapore Telelcome

Her small-mid cap picks are:

- Asiapharm

- Biosensor

- Bright World (this is her hot favourite)

- HTL

- Koda

- KS Energy

- Pacific Andes

- Rotary

- Tat Hong

Okay i have showed you her stock picks for 2007, you can place your bets now. :)

Sunday, November 26, 2006

Hsu Fu Chi

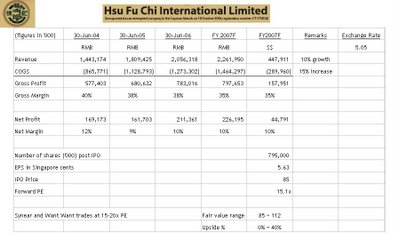

Looking at the valuation of the company, let’s take a closer look at the numbers. The gross margins are definitely attractive at 35% to 40% but the net margins definitely disappoints at 9%-12%. Synear and Want Want are able to generate better net margins than Hsu Fu Chi. While Synear is now trading at 30x and Want Want is at 17x historical PE. It remains to be seen if Hsu can attract such a valuation.

Based on my 2007F projections EPS of 5.63 cents and a fair value PE multiple of 15x-20x PE, it would indicate a fair value range of 85 cents to 112 cents. In that regard, a maximum pricing of 85 cents will mean that the counter is fairly valued at IPO price. It would definitely be more attractive if the underwriters can priced it below 80 cents (say 75 cents). The negatives about this Company are the rumors that it has failed to list in Hong Kong previously as well as the untested strength of its underwriter, Cazenove. However, the fact that the public float of 10m shares is relative large and that the IPO application period for the public tranche is only open for 5 days meant that the underwriter has already placed out all its 115m placement tranche and is confident that the 10m public tranche would be fully subscribed as well.

Sunday, November 19, 2006

Gallant Venture

I hope to post to my blog more regularly from now onwards and hopefully will help me and my little ninjas in uncovering little gems on the Singapore bourse.

The technical picture of GallantVentures looked rather bullish as it retriggered the parabolic SAR again and it also broke the downsloping resistance line. It has been on an upward trend since its IPO back in June 06. A longer term trader who wants to be in the market at all times will go long now at 95 centsand the 'cut loss' level is around the 86 cents as implied by the Parabolic SAR .

Fundamentally, the stock is not cheap as it trades at 52x 2006F PE. It may not be fair to use PE as a valuation methodology for a 'real estate' stock. Kim Eng gave two target price, 102 (if Lagoi Bay is developed) and 177 (present value of its total land bank and cashflows). I have no comments on the FA of this stock except that it is 'not very cheap' currently. However, if the value of its landbank rises as the island redevelops and attract more investors, that is another story altogether.

Monday, November 13, 2006

Pirates of the Caribbean

(The view from my hotel balcony. The Caribbean Sea really looks enticing isn't it?)

Frankly I am not a beach person (afterall, we are in Singapore!) but I must admit the sea with its various layered of crystal blue looks really clean and good. I couldn't help but join in the fun as well after all my meetings...

(The picture of a similar catamaran which i am in)

I decided to make the full use of time by taking a cruise to snorkel with the turtles and over some shipwreck. I sighted some flying fish there! It was really amazing to see that fish can 'fly'! The turtles are truly overfed from the daily feeding and snorkeling session as someone will 'lure in' the turtles with fish meat. The Captain warned all male participants to wear their trunks as the turtles will just bite anything that dangles and looks like a fish.

(stopover for lunch near Sandy Lane where Tiger Woods got married!)

We stopover for lunch at a place called Sandy Lane (the whitish building in the background). While it seemed nothing 'spectacular', it costs more than US$1,000 per room per night!!

Monday, September 18, 2006

HL Asia

Just to do a quick update on the position in HL Asia... The technical picture for HL Asia remains healthy and even though I am just glad it closes at 154 today (on low volume though), I would prefer to see more interest by institutional investors. It would need to break 155 strongly before we can hope to see it near to 160. In the meantime...continue to fall asleep watching this counter....zzzz.zzzz....

AEM Ever Tech

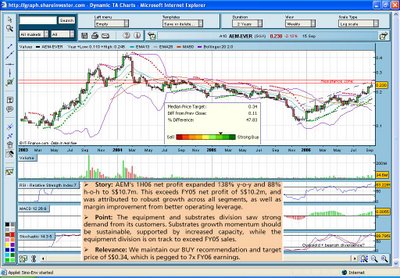

This is a chart request from my little ninja.

Fundamentally - AEM reported a good set of 1H 06 results and seemed to be the main beneficiary of an upswing in the semiconductor cycle! DBS gives it a 12 month target of 34 cents.

Based on 06F EPS of 4.9 Singapore cents, at 23 cents, it is last trading at a prospective PE of 4.7x (really cheap!) It's also trading below its projected 06 Dec book value of 24.7 cents! Assuming the Semiconductor upswing remains intact, this stock is really "value" for money.

Technically - AEM chart is on a nice uptrend but is entering its short term resistance zone around the 24-25 cents area. In order to see a better technical picture, i zoomed out to the weekly chart. Weekly chart pattern showed a 'shooting star' candle last week with overbought RSI and Stochastic. This may present a short term (1-3 weeks) correction down to the 21-22 cents support which in my opinion presents another opportunity to buy. The uptrend is likely to resume once the short term correction is over. If it breaks the 25 cents resistance, it should head towards the 30 cents mark.

Monday, September 11, 2006

What other says about my school

Anyway, Lesson 1 has started. Lesson 1 is on choosing the right brokerage firm. I am covering from ground zero upwards. It is like 'reliving' my experience on how I started onto this path of deciding to be a trader all over again.

IMF is coming to town!! Nicoll Highway will be closed to traffic from 10-20 Sep 2006 and i am forced to take a different route to office! Can the government compensate me for the higher ERP charges i have to pay because of this?! hehehe.. Our govt is really very powerful.. even the Channel 5 movie tonight (Charlie's Angel 2) and next Sunday (Matrix Reloaded) got some standard. While Mediacorp will definitely deny it frantically, somehow deep in my heart, i felt that this is also 'pre-arranged' to screen better shows during this period to welcome the IMF delegates. Personally I think some of the security arrangements are really "over-kill" measures like setting up barricades around the monuments... sigh.. what to do?!?! I am sure the "KFC" woman who planned to do a protest on chicken farming would know the powress of our police force.. and some people just never give up isnt it?!