Hsu Fu Chi

What kind of name is this? Sounds more like the CEO of SGX? Hahaha. Anyway this is a China F&B play and based on the positive sentiments right now, it should get a decent debut.

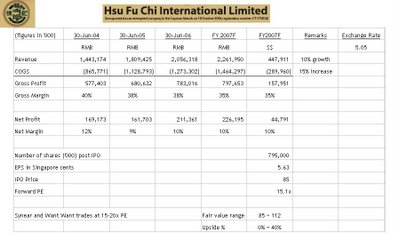

Looking at the valuation of the company, let’s take a closer look at the numbers. The gross margins are definitely attractive at 35% to 40% but the net margins definitely disappoints at 9%-12%. Synear and Want Want are able to generate better net margins than Hsu Fu Chi. While Synear is now trading at 30x and Want Want is at 17x historical PE. It remains to be seen if Hsu can attract such a valuation.

Based on my 2007F projections EPS of 5.63 cents and a fair value PE multiple of 15x-20x PE, it would indicate a fair value range of 85 cents to 112 cents. In that regard, a maximum pricing of 85 cents will mean that the counter is fairly valued at IPO price. It would definitely be more attractive if the underwriters can priced it below 80 cents (say 75 cents). The negatives about this Company are the rumors that it has failed to list in Hong Kong previously as well as the untested strength of its underwriter, Cazenove. However, the fact that the public float of 10m shares is relative large and that the IPO application period for the public tranche is only open for 5 days meant that the underwriter has already placed out all its 115m placement tranche and is confident that the 10m public tranche would be fully subscribed as well.

Looking at the valuation of the company, let’s take a closer look at the numbers. The gross margins are definitely attractive at 35% to 40% but the net margins definitely disappoints at 9%-12%. Synear and Want Want are able to generate better net margins than Hsu Fu Chi. While Synear is now trading at 30x and Want Want is at 17x historical PE. It remains to be seen if Hsu can attract such a valuation.

Based on my 2007F projections EPS of 5.63 cents and a fair value PE multiple of 15x-20x PE, it would indicate a fair value range of 85 cents to 112 cents. In that regard, a maximum pricing of 85 cents will mean that the counter is fairly valued at IPO price. It would definitely be more attractive if the underwriters can priced it below 80 cents (say 75 cents). The negatives about this Company are the rumors that it has failed to list in Hong Kong previously as well as the untested strength of its underwriter, Cazenove. However, the fact that the public float of 10m shares is relative large and that the IPO application period for the public tranche is only open for 5 days meant that the underwriter has already placed out all its 115m placement tranche and is confident that the 10m public tranche would be fully subscribed as well.